Kellogg's Stock Takes Big Hit After Phelps Bong Controversy

I'm no expert on the stock market, but this doesn’t look good for Kellogg's:

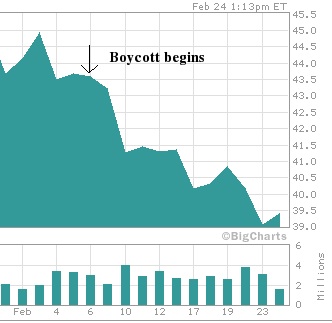

Kellogg Co. Stock -- February 2009:

As the chart shows, the company's stock took an immediate dive following its decision to drop Michael Phelps over the infamous bong hit photo. What began as a coordinated boycott by drug reform organizations quickly escalated into a full-blown media frenzy as major news outlets picked up the story. Pot-friendly websites like Digg.com began directing massive traffic to news coverage that was critical of Kellogg's anti-marijuana posturing, thereby increasing the campaign's visibility among likely supporters.

The cumulative impact of all this negative publicity is helpfully illustrated by The Vanno Reputation Index, which monitors the public image of leading corporations:

Out of the 5,600 company reputations Vanno monitors, Kellogg ranked ninth before it booted Phelps. Now it's ranked 83. Not even an industry-wide peanut scare inflicted as much damage on the food company's reputation. [Business Insider]

In the current economic climate, it would be silly to think we're solely responsible for Kellogg's falling stock. Still, the Vanno data clearly shows that we've dealt a substantial blow to the company's reputation at the worst possible time. Whether or not we actually had a considerable impact on Kellogg's bottom line is beside the point. What matters is that we sent an unprecedented message to corporate America that reefer madness is bad for business.

For far too long now, the drug war has been sustained by a corporate culture that embraces anti-drug propaganda at every turn. Just as our press and politicians have struggled to come to terms with evolving public attitudes about drugs and drug policy, corporate America has remained enslaved by the tired mindset that a healthy public image is best secured through hardline anti-drug posturing.

The Phelps saga may soon be regarded as the moment when all of that changed, the unforeseeable, yet inevitable moment when the invisible hand of America's marijuana culture finally became a fist.

Update: Many have pointed out, and I agree, that Kellogg's falling stock is much better explained by the economy than the boycott. I thought I did a sufficient job of drawing this distinction in the post, but I can understand how the title and tone of the overall post might lead some to conclude otherwise. So for the record: the point of the post is not that the marijuana reform community crashed Kellogg's stock. I don't believe that to be true. The point is that our message gains much better traction at a moment like this. The last thing Kellogg's wants is a highly publicized boycott in the middle of an economic crisis.

I've been skeptical of previous boycott proposals that have circulated among reformers in the past, but this effort has been a massive success. In terms of media coverage and the subsequent slaughter of Kellogg's corporate reputation ranking, we couldn't have asked for a more visible impact than we've managed to achieve.

Just because Kellogg's hasn't formally surrendered to us somehow doesn't mean we didn't kick their ass. I'm sure they are utterly stunned by the backlash they received, and that's what matters.

This work by StoptheDrugWar.org is licensed under Creative Commons Attribution-ShareAlike 4.0 International

Add new comment